The 1920s – Nevada Taxpayers Association Created

Seven members of a former taxpayers’ association met on February 16, 1922 and decided that it was important to continue reviewing taxes and expenditures in Nevada. With that decided, they set out to organize the new group.

On February 25, 1922, the organizational committee reported back and the Articles of the NEVADA PUBLIC ECONOMY LEAGUE were adopted. Nevada had a new taxpayer association. Mr. F. N. Fletcher, the recently retired Secretary of the Nevada Tax Commission was hired at a salary of $350 per month.

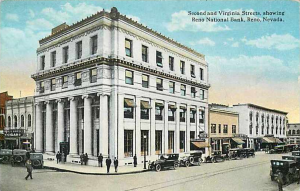

The first office was located in the Reno National Bank Building. Membership dues were established at 25 cents for each $100 of taxes paid (minimum dues was 50 cents). The first publication – Nevada Tax Review – was issued in December 1922. On February 9, 1926, at the annual General Membership meeting, the name of the League was changed to NEVADA TAXPAYERS ASSOCIATION.

Legislative stories of the decade were:

- The adoption of a bill to impose a gas tax at 2 cents per gallon;

- State tax levies;

- Creation of the State Survey Commission to review and streamline state government fiscal controls;

- A budget shortfall of $500,000 for which the controller and treasurer were arrested;

- And the cost of education which was (and still is) a recurring issue.

- There was also a Civil War claim against the Federal government by the State of Nevada for $595,076.53.

The 1930s – Nevada Gaming Law Established

Stories that concerned the impact of the Depression and the resultant decline in assessed valuation. One of the Depression solutions for additional revenue in Nevada was the suggestion to impose a State income tax (1931).

The Legislature opted instead for passing Assemblyman Tobin’s (Humboldt County) bill that established the Nevada Gaming Law and created the table games tax; the proceeds of which were shared by the state, counties, and incorporated and unincorporated towns. During this period, the Association advocated county-wide school districts.

The 1940s – Recognition of the Association by the Legislature

The Association was recognized by the Legislature in 1943 and 1945. Resolutions introduced during both sessions acknowledged the service the Association proved to legislators and interested members of NTA through their weekly legislative bulletins that furnished the history of all bills.

In 1947, a single page monthly newsletter – Tax Topics – was published. The Tax Review, which had served as the Association’s newsletter, became a quarterly publication. At the same time, the Directors formed a “General Council” represented by one member from each of the 17 counties.

The 1950s – The Association Focuses on Resolving the School Problems

In 1953, Mel Lundberg, President of the Association was appointed to serve on the committee to study the school problem by Governor Charles Russell.

Upon finding that no funds were made available for the study, the Association made available $2,500 “to conduct research in any manner it might see fit.” The committee issued the “Peabody Report” on school finance and organization. The major result of the report was the reduction of 307 school districts to the current 17 districts.

Neil Humphrey, who was hired by NTA in 1955, resigned in 1959 to become Budget Director for Governor Grant Sawyer. During Humphrey’s term, the Association was active in the “SOS” (Save Our Schools) campaign. The campaign was successful in obtaining voter approval by 1955 legislative action imposing a 2% state sales tax.

During this time, the Association’s office was moved from Reno to Carson City.

The 1960s – “Zubrow Report”

The state had its first (1960) and only annual session which was approved by the voters in the 1958 General Election. The Association’s Executive Secretary, Howard Barrett, was appointed to serve on the Citizens Committee on Taxation and Fiscal Affairs that resulted in the “Zubrow Report”.

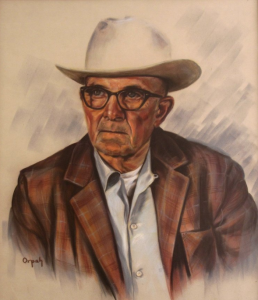

Barrett resigned in 1961 to become Budget Director for Government Grant Sawyer. Ernest “Ernie” Newton was hired in 1962 as Executive Vice President and began a 20 year tenure with NTA.

The 1970s – Adoption of the First Billion Dollar Budget

The Association legislative reported on

- the adoption of the first billion dollar budget (1977);

- the statutory reduction of the property tax rate to $3.64 per $100 of assessed valuation (1979);

- and opposed the removal of the sales tax from food on the basis it would remove the stability of sales tax as a revenue source.

- Also opposed was the proposed Constitutional amendment which appeared on the 1978 November ballot – Nevada’s answer to California’s property tax relief measure.

- At the same time, the Association supported the reorganization study released by the State.

The 1980s – “Tax Shift” and Major Changes in the NTA

The “Tax Shift“, whereby the revenue dependency of local government was changed from property tax to sales tax. The Association supported the move on the basis it would save the property taxpayer over $100 million.

Ernie Newton retired in 1982. Howard Barrett (who retired as State Budget Director in 1981) rejoined the Association as Executive Vice President, serving in that capacity until 1984.

Roy Nickson, former Executive Director of the Nevada Department of Taxation, was then hired to fill the position. Spearheaded by then President James Cashman, Jr. a major change in the bylaws and dues structure allowed the opening of a branch office in Las Vegas (March, 1986).

Carole Vilardo was hired to oversee that office and lobby the Legislature. Upon the retirement of Nickson in 1988, Vilardo was made Executive Director. The Association’s Legislative Report underwent a major change in format.

The 1990s

The Board of Directors adopted a far-reaching policy statement that called for proactive fiscal reform and established a fiscal agenda of legislation. As a result, the “Taxpayer Bill of Rights” (TBR) was requested and signed into law (1991).

When passage of the TBR was in doubt because of a lack of state funds for printing, NTA edited and secured member donations to pay for the printing of 100,000 copies.

Also passed in 1991 was legislation to eliminate the spending of State surplus revenues for ongoing operational expenditures (a.k.a. “triggers”), and the creation of a State budget stabilization account (rainy-day fund).

The first candidate Tax and Budget Workshops were held by NTA in 1992 to assist candidates in understanding Nevada’s fiscal system.

Nevada Taxpayers luncheon - Hosted by Mitch Fox

Year 2012 – Panel Discussion of Four Nevada Governors Hosted by Nevada Taxpayers Association

The Association assisted raising money to fund a State Government Reorganization Study, which was chaired by former NTA Board member and current Governor Kenny Guinn and supported same during the 1993 Legislative session.

A new NTA publication, Nevada Issues, made its debut. The second Nevada Issues – “Financing Nevada’s Infrastructure”, became the basis for legislative proposals adopted in the 1993 and 1995 legislative sessions. Included in those proposals was the “debt management” bill and the permissive creation by local governments of budget stabilization and capital set-aside trust funds.

In 1993 and 1996 respectively, two new publications were added — Understanding Nevada’s Property Tax System and Understanding Nevada’s Personal Property Tax.

The work on the latter publication became the basis of NTA’s legislative request to eliminate “consumable goods” from being subject to the personal property tax.

That legislation effective July 1996 save businesses in Nevada over $2 million dollars per year, and more importantly, eliminated the compliance and administrative problems associated with reporting consumable supplies.

On February 25, 1997 (75 years to the date), NTA’s anniversary was celebrated with a gala dinner. Then current Governor Robert Miller and former Governor Robert List joined NTA Chairman Fred Gibson, Jr. and five of the Association’s Past Chairmen on the dias in honor of the event. The establishment of the CASHMAN GOOD GOVERNMENT AWARD was announced.

The prior month, Governor Miller’s State of the State address acknowledged the efforts of the Association in bringing the “Computers for Schools” program to the attention of the administration.

Most of the legislative requests from the Association were passed including:

- The interim legislative committee on revenue distribution being made a standing committee;

- Strengthening the provisions of the “Taxpayers Bills of Rights”;

- Creation of a Taxpayers Bill of Rights to deal with license and fee issues;

- Prohibiting voter approved property tax bond issues and operating overrides from accruing to redevelopment districts;

- Repealing the prospective payment of the insurance premium tax (effective January, 1998);

- And changing the payment schedule to actual.

The Association was also successful in stopping bills which would have increased property taxes above the allowed levels saving millions of dollars for Nevada property tax payers.