Nevada Taxpayers Association

Serving the citizens of Nevada since 1922!

Nevada Taxpayers Association, a 501 (c)(4), advocates for Nevada’s taxpayers, and sound fiscal policies in tax and expenditure matters, which provide efficiency, accountability, fiscal sanity, and common sense. NTA also promotes the cause of the taxpayers, for responsible government at a reasonable price.

Tax Resources

Membership Info

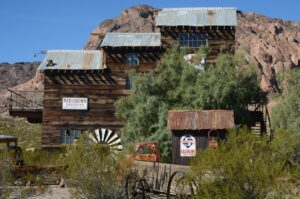

History of the NTA

• The establishment of the Cashman Good Government Award to honor a government employee or agency for innovations that have resulted in a more efficient, cost-effective, user-friendly government.

• Conducts biennial Tax and Budget Workshops for legislative candidates, other elected officials, and members.

• Considered the primary resource by printed and electronic media in Nevada for information on all tax and related issues.

• Member of the National Taxpayers Conference

• Members of the Governmental Research Association

• A “Taxpayers Bill of Rights”;

• Legislation to create a State stabilization fund (AKA Rainy Day Fund);

• The elimination of “consumable goods” from business personal property taxes;

• The changing of a prospective payment of the insurance premium tax to actual payment;

• A standing legislative committee to review the formulas and distribution of Nevada Taxes